How to Open a Domiciliary Account in Nigeria: Step-by-Step Guide for 2025

In today’s digital economy, knowing how to open a domiciliary account in Nigeria is more important than ever, especially for individuals and businesses involved in international transactions. Whether you’re a freelancer receiving payments from clients abroad, a business owner dealing with import/export, or a student planning to study overseas, a domiciliary account gives you the ability to receive and send foreign currency (USD, GBP, EUR) directly.

This comprehensive guide will walk you through how to open a domiciliary account in Nigeria, the benefits, requirements, and tips to manage it effectively.

What Is a Domiciliary Account?

A domiciliary account (also called a dom account) is a type of bank account that allows you to receive, save, and transfer foreign currencies like the US Dollar (USD), British Pound (GBP), and Euro (EUR). Unlike a regular Naira savings or current account, a dom account is specifically tailored for international transactions.

With this account, you can:

-

Receive money from abroad via wire transfer

-

Pay for international services or products online

-

Withdraw or deposit foreign currencies over the counter

-

Save in stable currencies to hedge against the Naira’s depreciation

Why You Need a Domiciliary Account in Nigeria

If you’re wondering why many Nigerians are rushing to open domiciliary accounts, here are key reasons:

1. Receive International Payments Easily

Freelancers, remote workers, affiliate marketers, YouTubers, bloggers, and importers can all benefit from receiving payments directly in foreign currencies. Platforms like Payoneer, Upwork, Fiverr, and Amazon pay in USD or other major currencies.

2. Protect Against Naira Devaluation

The Naira’s value has fluctuated significantly. By holding your money in USD, EUR, or GBP, you can store value and avoid losses due to devaluation.

3. Pay for Online Services

With a domiciliary account, you can link your account to international payment gateways or use it to get a Dollar card. This makes paying for subscriptions like Netflix, Spotify, Apple Music, and web hosting services easier.

4. Smooth International Transactions

A dom account helps students paying foreign school fees, businesses importing goods, or tourists booking international flights and hotels.

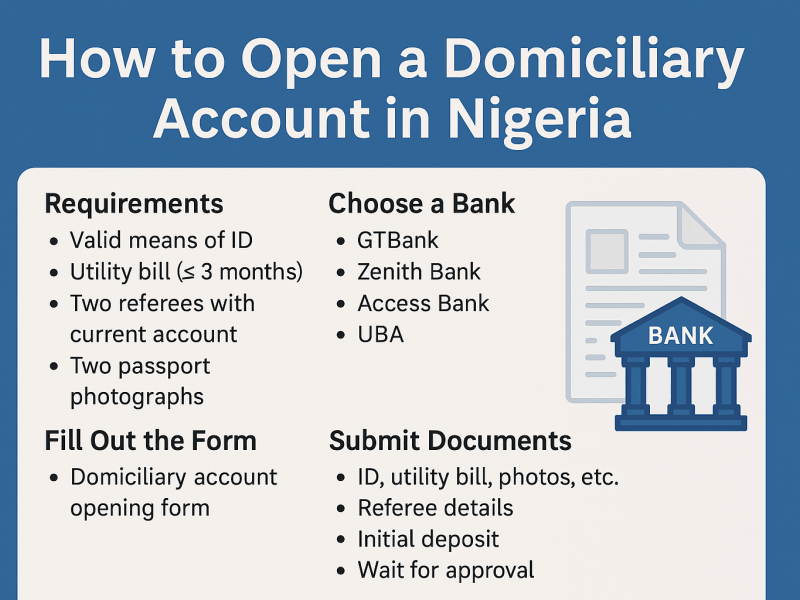

Requirements to Open a Domiciliary Account in Nigeria

Before heading to the bank, make sure you have the following requirements ready:

1. Valid Means of Identification

This could be:

-

National ID Card (NIN)

-

International Passport

-

Driver’s License

-

Voter’s Card

2. Utility Bill (Not Older than 3 Months)

You need a NEPA bill, water bill, or any official document showing your current address.

3. Two Referees with Current Account

Most banks will ask for two referees who hold a current account with the same bank or a reputable Nigerian bank. This is to verify your credibility.

Tip: Some banks now allow you to use only one referee or waive this requirement for existing customers.

4. Two Passport Photographs

Recent passport photographs with a clear background.

5. Minimum Opening Balance

Banks may require:

-

$100 to $200 for a USD account

-

£100 for a GBP account

-

€100 for a Euro account

How to Open a Domiciliary Account in Nigeria – Step-by-Step

Now that you have the requirements ready, here’s how to open a domiciliary account in Nigeria in 2025:

Step 1: Choose the Right Bank

Popular Nigerian banks that offer domiciliary accounts include:

-

GTBank (Guaranty Trust Bank)

-

Zenith Bank

-

Access Bank

-

UBA (United Bank for Africa)

-

First Bank of Nigeria

-

FCMB

Choose a bank based on factors like customer service, availability of online banking, and foreign exchange accessibility.

Step 2: Visit a Branch or Start Online

Some banks allow you to start the application process online by filling a form. However, you may still need to visit a branch to finalize the documentation and verification.

Step 3: Fill Out the Domiciliary Account Opening Form

You will be asked to provide personal information, details of your referees, and upload your documents.

Step 4: Submit the Required Documents

Provide your:

-

Valid ID

-

Utility bill

-

Passport photographs

-

Referee details

-

Initial deposit (if required)

Step 5: Wait for Approval

Once your application is submitted, the bank will verify your documents and contact your referees. This process may take 24 to 72 hours.

Step 6: Get Your Account Details

After approval, you’ll receive your domiciliary account number, SWIFT code, and bank routing instructions. You can now start receiving money from abroad.

Best Banks to Open a Domiciliary Account in Nigeria in 2025

Here’s a quick comparison of some top banks and what they offer:

| Bank | Minimum Opening Balance | FX Transfer Fees | Online Access |

|---|---|---|---|

| GTBank | $100 | $10 per transfer | Yes |

| Zenith Bank | $100 | Varies | Yes |

| Access Bank | $50–$100 | Varies | Yes |

| First Bank | $100 | Varies | Yes |

| UBA | $100 | Competitive | Yes |

Note: Always confirm updated fees and minimum deposit at the branch or official website, as they may change due to FX policies.

How to Fund Your Domiciliary Account in Nigeria

You can fund your domiciliary account through:

-

International wire transfers (from clients, family, etc.)

-

Cash deposits at the bank in USD, GBP, or EUR

-

Transfer from another domiciliary account

Due to CBN regulations, you cannot fund your dom account directly with Naira. You must use foreign currency cash or receive international funds.

How to Withdraw from a Domiciliary Account in Nigeria

You can withdraw money from your domiciliary account through:

-

Over-the-counter cash withdrawal (present a withdrawal slip and ID)

-

Use a Dollar debit card (if your bank offers one)

-

Transfer to another domiciliary account

If you need to convert the funds to Naira, you can:

-

Sell the dollars to Bureau de Change (BDC) operators

-

Withdraw in USD and exchange at the parallel market

-

Use your bank’s FX services (less favorable rates)

Common Challenges and Solutions

1. Referee Requirement

Some people struggle to get referees. Solution: Use a bank like GTBank or UBA, which may accept just one referee or allow an existing customer to endorse your application.

2. Bank Delays

Processing times may vary. Follow up consistently, and ask for alternatives like premium account opening.

3. FX Scarcity

The Central Bank of Nigeria (CBN) sometimes imposes restrictions on foreign exchange. To mitigate this, try different banks, or fund your account through international clients or family abroad.

Tips to Manage Your Domiciliary Account Effectively

-

Link it to a Payoneer or Wise account for smoother international transfers

-

Always keep track of exchange rates before selling your forex

-

Avoid unnecessary bank charges by understanding fee structures

-

If you receive frequent payments, ask for a Dollar Mastercard or Visa card

Final Thoughts

Opening a domiciliary account in Nigeria is a smart financial move for anyone involved in international transactions. Whether you’re a freelancer, business owner, or student, having access to foreign currencies protects your earnings and provides more flexibility in today’s global economy.

Now that you know how to open a domiciliary account in Nigeria, gather your documents, choose the right bank, and get started today. It’s a move that will boost your financial freedom and open doors to global opportunities.