Mortgages are loans from banks or lenders that allow borrowers to purchase a home. The borrower makes monthly payments to the mortgage lender, and the mortgage is paid off in full after a certain period of time. The lender also charges interest on the loan. As you read further you will understand consecutively How Mortgages Work.

How Does The Mortgage Interest Work?

Mortgage interest is a key component of a home loan, and it’s important to understand how it works, especially if you’re planning to buy a home. Here is a breakdown of how mortgage interest works:

1. Principal and Interest:

When you take out a mortgage to buy a home, the loan amount you borrow is called the “principal.” The mortgage lender charges you interest on this principal as compensation for lending you the money.

2. Interest Rate:

The interest rate is the annual percentage rate (APR) that the lender charges on the principal amount. It’s expressed as a percentage. The interest rate is a critical factor in determining your monthly mortgage payments.

3. Fixed vs. Adjustable Rate:

Mortgages can have either fixed interest rates or adjustable interest rates. With a fixed-rate mortgage, the interest rate remains constant throughout the loan term, making it easier to budget for your monthly payments. With an adjustable-rate mortgage (ARM), the interest rate can change periodically, usually after an initial fixed period.

4. Monthly Payments:

Your monthly mortgage payment typically includes both principal and interest. The amount of interest paid is higher at the beginning of the loan term and gradually decreases as you pay down the principal balance.

5. Amortization:

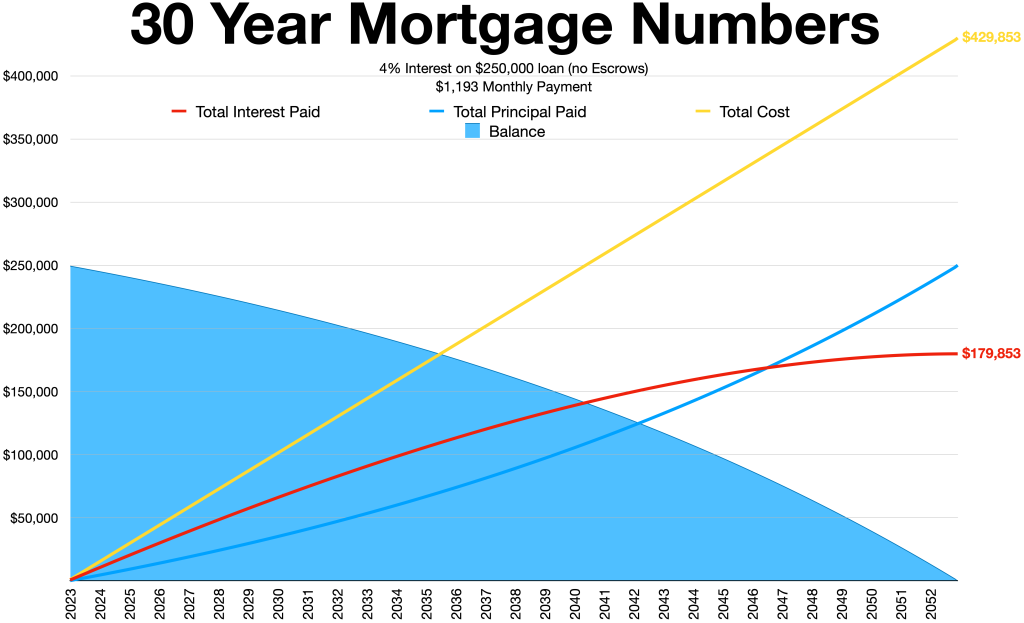

Mortgage loans are usually set up with an amortization schedule, which is a table that shows how each monthly payment is divided between interest and principal. In the early years of the mortgage, a larger portion of your payment goes toward interest, while in the later years, more goes toward reducing the principal.

6. Tax Deductibility:

In some countries, including the United States, mortgage interest payments may be tax-deductible. This can provide a financial benefit to homeowners, as it reduces their taxable income.

7. Impact on Total Cost:

The total cost of your mortgage depends not only on the interest rate but also on the length of your loan term. A longer-term loan will result in more total interest paid over time, even if the interest rate is lower. Shorter-term loans generally have higher monthly payments but lower total interest costs.

8. Refinancing:

Some homeowners choose to refinance their mortgages to get a lower interest rate, which can reduce monthly payments and overall interest costs. Refinancing can also allow you to change from an adjustable-rate to a fixed-rate mortgage or vice versa.

9. Prepayment:

Making extra payments toward the principal balance can help you pay off your mortgage faster and reduce the total interest paid over the life of the loan. However, it’s essential to check your mortgage terms for any prepayment penalties.

In summary, mortgage interest is the cost you pay to borrow money to buy a home. It’s a significant factor in determining your monthly mortgage payments and the total cost of your loan. Understanding how interest works can help you make informed decisions when choosing a mortgage and managing your finances as a homeowner.

This might also Interest you : Why Property Insurance is Important for You

Mortgage Interest vs. Principal

Mortgage interest and principal are two key components of your monthly mortgage payment. Understanding the difference between them is essential for managing your mortgage effectively:

1. Principal:

- The principal is the initial loan amount you borrowed to purchase your home.

- It represents the actual cost of the home and is what you need to repay to eventually own the property outright.

- As you make your monthly mortgage payments, a portion of each payment goes toward reducing the principal balance.

- Paying down the principal is how you build equity in your home, which is the difference between the home’s value and the remaining mortgage balance.

2. Interest:

- Interest is the cost of borrowing money from the lender.

- It is calculated based on the interest rate applied to the outstanding principal balance.

- In the early years of your mortgage, a significant portion of your monthly payment goes toward paying interest, while a smaller portion goes toward paying down the principal.

- Over time, as you make more payments and reduce the principal balance, the portion of your payment applied to interest decreases, and the portion applied to the principal increases.

In summary, the principal is the amount you borrowed to buy your home, and paying it down is how you build equity and eventually own your home outright. Interest is the cost you pay to the lender for borrowing that money, and it’s based on the outstanding principal balance and the interest rate. Your monthly mortgage payment is a combination of both principal and interest, and the specific breakdown between the two changes over the life of the loan, with more going toward principal as the loan is paid down.

Fixed-Rate Interest vs. Adjustable-Rate Interest

Fixed-rate interest and adjustable-rate interest are two common types of interest structures in mortgage loans. They differ in how the interest rate is set and whether it remains constant or changes over time:

Fixed-Rate Interest:

- Constant Interest Rate: In a fixed-rate mortgage, the interest rate remains constant throughout the entire loan term. This means that your monthly mortgage payment remains the same from the start of the loan until the end, providing predictability and stability for borrowers.

- Long-Term Certainty: Fixed-rate mortgages are popular because they offer long-term certainty. You’ll know exactly what your mortgage payment will be for the entire loan term, which makes budgeting easier and protects you from rising interest rates.

- Higher Initial Interest Rate: Fixed-rate mortgages typically have slightly higher initial interest rates compared to adjustable-rate mortgages because lenders are assuming the risk of future interest rate fluctuations.

- Protection Against Rate Increases: With a fixed-rate mortgage, you are protected from rising interest rates during your loan term. If market interest rates go up, your mortgage rate and payment remain unchanged.

- Less Flexibility: Fixed-rate mortgages may offer less flexibility than adjustable-rate mortgages, especially if interest rates in the broader economy decrease. Refinancing to take advantage of lower rates may require you to go through a formal refinance process.

Adjustable-Rate Interest (ARM):

- Variable Interest Rate: In an adjustable-rate mortgage (ARM), the interest rate is initially set at a fixed level for a specific period (often 3, 5, 7, or 10 years). After this initial period, the interest rate can adjust periodically based on a predetermined index and margin.

- Lower Initial Interest Rate: ARMs typically offer lower initial interest rates compared to fixed-rate mortgages, which can result in lower monthly payments during the initial fixed period.

- Interest Rate Risk: The main risk with ARMs is that your interest rate can increase when it adjusts, potentially leading to higher monthly payments. The extent of the increase is determined by the index and margin used in the adjustment process.

- Periodic Adjustments: After the initial fixed period, the interest rate on an ARM can adjust at specified intervals (e.g., annually or semi-annually). There are caps in place to limit how much the rate can change during each adjustment period and over the life of the loan.

- Savings in a Falling Rate Environment: If interest rates in the broader economy decrease, borrowers with ARMs may benefit from lower monthly payments without the need to refinance.

Choosing between a fixed-rate mortgage and an adjustable-rate mortgage depends on your financial goals, risk tolerance, and how long you plan to stay in the home. Fixed-rate mortgages provide stability, while ARMs can offer lower initial payments but come with the potential for rate increases in the future. It’s essential to carefully consider your financial situation and the terms of the mortgage before making a decision.

Interest-Only Mortgages

An interest-only mortgage is a type of home loan where the borrower pays only the interest on the loan for a specific period, typically the first few years of the loan term. After this initial interest-only period, the loan usually converts to a more traditional mortgage structure, where the borrower pays both principal and interest. Here are some key points to understand about interest-only mortgages:

1. Interest-Only Period:

During the interest-only period, the borrower is not required to make payments toward the principal balance of the loan. They only need to pay the interest that accrues on the outstanding loan balance.

2. Lower Initial Payments:

Because you’re not paying down the principal balance during the interest-only period, your monthly mortgage payments are generally lower than they would be with a traditional mortgage where you’re paying both principal and interest.

3. Temporary Solution:

Interest-only mortgages are often used as a temporary financial strategy. Borrowers may choose this option when they expect their income to increase significantly in the future, plan to sell the property before the interest-only period ends, or have other short-term financial goals.

4. Risks:

Interest-only mortgages come with risks. Once the interest-only period ends, your monthly payments will typically increase significantly because you’ll start paying both principal and interest. If you’re not financially prepared for these higher payments, it can lead to payment shock.

5. No Equity Buildup:

During the interest-only period, you’re not building equity in your home. Equity represents the value of your home that you own outright. With traditional mortgages, you build equity with every payment. With interest-only loans, you’ll need to rely on property appreciation to see any increase in equity during the initial period.

6. Qualification:

Qualifying for an interest-only mortgage may be more challenging than getting a traditional mortgage. Lenders often require higher credit scores and larger down payments because of the associated risks.

7. Variations:

There are variations of interest-only mortgages, such as “interest-only jumbo loans” for high-value properties. These loans may have more flexible terms and can be customized to meet specific borrower needs.

8. Regulation:

After the global financial crisis in 2008, many countries introduced stricter regulations on interest-only mortgages to prevent excessive risk-taking. As a result, these loans may not be as readily available as they once were.

Interest-only mortgages can be suitable for certain financial situations and goals, but they come with significant risks and should be approached with caution. It’s crucial to understand the terms of the loan, have a clear plan for how you’ll manage the higher payments when the interest-only period ends, and consult with a financial advisor or mortgage expert before deciding on this type of mortgage.

Jumbo Mortgage Loans

A jumbo mortgage loan, often referred to as a “jumbo loan,” is a type of home loan that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA) in the United States. These conforming limits vary by location and are designed to establish a maximum loan size that government-sponsored enterprises like Fannie Mae and Freddie Mac can purchase or guarantee. Jumbo loans, therefore, are too large to be eligible for purchase by these entities. Here are some key points to understand about jumbo mortgage loans:

1. Loan Size:

The primary characteristic of a jumbo loan is that it exceeds the conforming loan limits. These limits can change annually and vary by county or metropolitan area. Jumbo loans typically start at loan amounts above these limits, which are often set at $548,250 or higher as of my knowledge cutoff date in 2021.

2. Higher Borrowing Limits:

Jumbo loans allow borrowers to purchase more expensive homes or refinance existing properties with larger outstanding loan balances.

3. Stricter Qualification Requirements:

Jumbo loans often come with more stringent qualification criteria. Lenders may require borrowers to have higher credit scores, lower debt-to-income ratios, and larger down payments compared to conforming loans. This is because lenders assume more risk with larger loan amounts.

4. Interest Rates:

Interest rates on jumbo loans can be higher than those on conforming loans because they are considered riskier for lenders. However, the exact interest rate will depend on your creditworthiness, down payment, and other factors.

5. Flexibility:

Jumbo loans offer flexibility in terms of adjustable-rate or fixed-rate options. Borrowers can choose between various loan terms, including 15, 30, or even 40 years, depending on the lender.

6. Documentation and Requirements:

Lenders may require additional documentation and proof of assets to approve jumbo loans, given their larger size. Borrowers should be prepared to provide thorough financial documentation.

7. No Government Backing:

Unlike conforming loans, which are eligible for government-backed guarantees through Fannie Mae and Freddie Mac, jumbo loans do not have this backing. Lenders retain the full risk for these loans.

8. Private Mortgage Insurance (PMI):

If you have a down payment of less than 20% on a jumbo loan, you may be required to pay for private mortgage insurance, which protects the lender in case of default. PMI costs can add to the overall cost of the loan.

9. Market Conditions:

Jumbo loan availability and terms can vary depending on market conditions and economic factors. In some cases, lenders may tighten or loosen their jumbo loan requirements based on economic conditions.

10. Regional Variations:

Loan limits for jumbo loans can vary significantly by region, and high-cost areas typically have higher limits to account for more expensive real estate markets.

It’s important to work closely with a knowledgeable mortgage lender or broker when considering a jumbo loan to understand the specific requirements, terms, and interest rates available to you based on your financial situation and the property’s location. Additionally, since the mortgage market can change over time, it’s a good idea to stay informed about current loan limits and lending practices.

What Interest Rate Will I Get When I Take out a Mortgage?

The interest rate you will get when you take out a mortgage depends on a variety of factors, and it can vary from one borrower to another. Lenders consider several key elements when determining the interest rate for your mortgage. Here are the primary factors that influence your mortgage interest rate:

1. Credit Score:

Your credit score is one of the most significant factors affecting your mortgage rate. Borrowers with higher credit scores typically receive lower interest rates because they are considered less risky by lenders. On the other hand, borrowers with lower credit scores may receive higher interest rates or have more limited loan options.

2. Loan Type:

The type of mortgage you choose can impact your interest rate. Common types of mortgages include fixed-rate, adjustable-rate, jumbo loans, FHA loans, and VA loans. Each of these loan types may have different interest rate structures.

3. Loan Term:

The length of your loan term also affects your interest rate. Typically, shorter-term loans (e.g., 15-year mortgages) have lower interest rates than longer-term loans (e.g., 30-year mortgages). This is because lenders assume less risk with shorter loan terms.

4. Down Payment:

The size of your down payment can influence your interest rate. A larger down payment often leads to a lower interest rate because it reduces the lender’s risk. Borrowers with down payments of 20% or more may avoid the need for private mortgage insurance (PMI), which can add to the overall cost of the loan.

5. Debt-to-Income Ratio (DTI):

Lenders assess your debt-to-income ratio, which is the percentage of your monthly income that goes toward debt payments. Borrowers with lower DTIs are generally considered less risky and may qualify for lower interest rates.

6. Property Type:

The type of property you’re buying can impact your interest rate. Lenders may have different rates for single-family homes, condos, multi-unit properties, and investment properties.

7. Market Conditions:

Overall market conditions and economic factors, including changes in the benchmark interest rates set by central banks, can influence mortgage rates. Mortgage rates can fluctuate daily based on these factors.

8. Lender and Loan Program:

Different lenders offer different mortgage rates, so it’s a good idea to shop around and compare offers from multiple lenders. Additionally, specific loan programs or promotions may have unique interest rate offerings.

9. Discount Points:

Some borrowers choose to pay discount points upfront to lower their interest rates. Each point typically costs 1% of the loan amount and can lower the interest rate by a certain percentage, depending on the lender.

10. Location:

Mortgage rates can vary by location due to regional housing market conditions and other factors.

To determine the interest rate you’ll receive, you’ll need to apply for a mortgage and go through the underwriting process with a lender. During this process, the lender will review your financial information, credit history, and other relevant factors to determine your specific interest rate. It’s a good practice to get pre-approved for a mortgage to understand the rates and loan options available to you before you start shopping for a home.

Why Is My Monthly Mortgage Payment Changing Even Though My Interest Rate Is Fixed?

If your monthly mortgage payment is changing even though you have a fixed interest rate, it’s likely due to other factors associated with your mortgage. While the interest rate itself remains constant on a fixed-rate mortgage, several components of your monthly payment can change over time. Here are some reasons for the changes:

1. Escrow Account Adjustments:

Many homeowners have an escrow account set up by their mortgage lender to cover property taxes and homeowners insurance. These costs can change over time, leading to adjustments in your monthly payment. If your property taxes or insurance premiums increase, your lender will adjust your escrow payments to ensure there are enough funds to cover these expenses.

2. Property Tax Changes:

Property tax rates can change, and the assessed value of your property may also fluctuate, leading to changes in your property tax bill. If your property taxes increase, your lender will adjust your monthly payment to accommodate the higher tax amount.

3. Homeowners Insurance Premiums:

Your homeowners insurance premiums can change due to various factors, including changes in the coverage amount, the insurance company’s rates, or your claims history. If your insurance premiums increase, your lender will adjust your monthly payment accordingly.

4. Private Mortgage Insurance (PMI):

If you have a conventional mortgage and your initial down payment was less than 20% of the home’s purchase price, you may be required to pay for PMI. PMI rates can vary, and if they increase, your monthly PMI premium and overall mortgage payment will also increase.

5. Adjustable-Rate Portion of a Hybrid ARM:

Some borrowers have hybrid adjustable-rate mortgages (ARMs) with a fixed-rate period followed by an adjustable-rate period. If your mortgage has entered the adjustable-rate phase, changes in interest rates can lead to fluctuations in your monthly payment.

6. Amortization:

Even with a fixed interest rate, the way your mortgage is amortized can lead to changes in your monthly payment. In the early years of the loan, a larger portion of your payment goes toward interest, while in later years, more goes toward paying down the principal. This means your payment may increase slightly over time as you pay down the principal balance.

7. Special Assessments:

Depending on your location and property type, you may be subject to special assessments or fees imposed by local authorities or homeowners’ associations. These fees can change and affect your monthly payment if they are included in your escrow account.

8. Adjustment of Fixed Costs:

In some cases, fixed costs such as mortgage insurance premiums or other fees associated with your loan can change, affecting your monthly payment.

To understand why your monthly mortgage payment is changing, carefully review your loan statements, and communicate with your lender. It’s essential to stay informed about any adjustments or changes related to your mortgage and to budget accordingly for these fluctuations in your housing costs.

Why Is It Better to Have a Lower Interest Rate on My Mortgage?

Having a lower interest rate on your mortgage can provide several significant advantages and financial benefits. Here are some of the key reasons why it’s generally better to have a lower interest rate on your mortgage:

1. Lower Monthly Payments:

A lower interest rate results in lower monthly mortgage payments. This can make homeownership more affordable, reduce your monthly financial burden, and free up funds for other expenses or savings goals.

2. Cost Savings Over the Life of the Loan:

A lower interest rate means you’ll pay less interest over the life of your mortgage. This can result in substantial cost savings, potentially tens of thousands of dollars, depending on the loan amount and term.

3. Faster Equity Building:

With a lower interest rate, a larger portion of your monthly payment goes toward paying down the principal balance of your mortgage. This accelerates the rate at which you build equity in your home.

4. Easier Budgeting:

A fixed-rate mortgage with a lower interest rate provides stability and predictability in your monthly housing costs. You won’t have to worry about sudden increases in your mortgage payment due to interest rate fluctuations.

5. Improved Debt-to-Income Ratio:

A lower monthly mortgage payment relative to your income can improve your debt-to-income (DTI) ratio. A lower DTI ratio is generally viewed favorably by lenders and can make it easier to qualify for other loans or credit.

6. More Affordable Refinancing:

If market interest rates drop significantly after you’ve secured your mortgage, you’ll have a better chance of benefiting from refinancing to a lower rate. This can further reduce your mortgage costs.

7. Higher Home Affordability:

A lower interest rate can increase your purchasing power when buying a home. With the same monthly budget, you can afford a more expensive property, or you can choose to keep your budget steady while enjoying lower monthly payments.

8. Reduced Total Loan Cost:

Over the life of your mortgage, a lower interest rate reduces the overall cost of your loan. This means you pay less for the privilege of borrowing money to buy your home.

9. Protection Against Rate Increases:

With a fixed-rate mortgage, a low initial interest rate protects you from potential future interest rate increases. If market rates rise, your mortgage rate remains unchanged, and you won’t see a rise in your monthly payment.

10. Financial Flexibility:

Lower mortgage payments can free up money for other financial goals, such as saving for retirement, investing, paying for your children’s education, or tackling high-interest debt.

In summary, securing a lower interest rate on your mortgage can have a substantial positive impact on your financial well-being. It can reduce your monthly payments, save you money over the life of the loan, and provide financial stability and flexibility. Therefore, it’s generally advisable to shop around for the best possible interest rate and take steps to improve your creditworthiness to secure the lowest rate available to you when obtaining a mortgage.

CONCLUSION

In conclusion, understanding how mortgage interest works, the difference between interest and principal, the types of mortgage interest rates (fixed and adjustable), and the factors that influence your mortgage interest rate is crucial for making informed decisions about homeownership. Your choice of mortgage type and interest rate can have a significant impact on your monthly payments, overall loan costs, and financial stability.

Fixed-rate mortgages offer predictability and protection against rising interest rates, making them a popular choice for those seeking stability in their housing expenses. On the other hand, adjustable-rate mortgages can provide lower initial payments but come with the risk of future rate increases.

When considering a mortgage, factors such as your credit score, loan type, loan term, down payment, and market conditions will all influence the interest rate you receive. A lower interest rate can lead to lower monthly payments, cost savings over the life of the loan, and faster equity building.

It’s essential to carefully review your mortgage terms, budget for potential changes in monthly payments, and explore opportunities to secure the best possible interest rate. Working with a knowledgeable lender and financial advisor can help you navigate the complexities of the mortgage market and make informed decisions that align with your financial goals and circumstances.